Sunday, December 3, 2017

Triffin, Tinbergen and Preventing the Next Global Financial Crisis

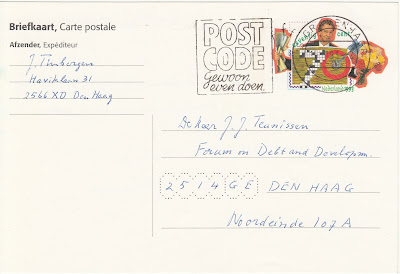

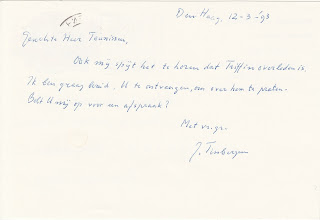

When Robert Triffin died I asked Jan Tinbergen if I could interview him about Triffin. As Tinbergen had much sympathy for Triffin and was on the Board of Advisors of FONDAD, he immediately sent me a postcard saying he was sad to hear about the death of Triffin and would be delighted to talk about him. He asked me to call him for an appointment.

I went to his home in The Hague, in Haviklaan, a rather modest house where he lived alone (his wife had died). I had been there before. In one of my visits I had proposed to arrange a taxi for him to facilitate his attendance to a FONDAD Conference at the Ministry of Foreign Affairs. "Thanks for the offer," he said, "but I prefer to go by tramway." And there he sat quietly at a table when I entered the conference room on the morning the conference started. I greeted him, we exchanged a few words and later, when I welcomed other participants, I pointed at the man with white hair sitting modestly and quietly at the table. "Is he really the great Jan Tinbergen?" asked one participant.

Tinbergen and I had a long conversation about Triffin and I incorporated part of what Tinbergen said in an article I wrote for the Duch newspaper NRC Handelsblad, "Robert Triffin, een bevlogen monetair genie" - Robert Triffin, a passionate monetary genius. Tinbergen reminded me of the key role he had given to Triffin in preparing the Report of the so-called RIO Group chaired by Tinbergen. He had asked Triffin to write the first technical report included in the report ("Reshaping the International Order") about the need to reform the international monetary system.

Triffin and the next global financial crisis

In that NRC Handelsblad article, I also included memories of Triffin's activities by Johannes Witteveen, Emile van Lennep and Tom de Vries, whom I had interviewed as well. The first two were also on the Advisory Board of FONDAD. Emile van Lennep's conclusion was: "In the long run, I always see a Triffin problem: how can one prevent international inflation or deflation."

Van Lennep's conclusion is shared by members of Robert Triffin International (RTI), a think group about the international financial system to which I also belong.

A FONDAD Group of 40 experts (FG40) is currently engaged in a discussion about how to prevent the next global financial crisis. I hope to inform you soon (within 3 months) about the outcome of that discussion.

Below is the first page of the article in NRC Handelsblad I wrote about Triffin in 1993. On the picture you see a meeting of the so-called Bellagio Group of academics and policymakers, which was similar to meetings organised by FONDAD. Emile van Lennep and Robert Triffin were key members of the Bellagio Group. I felt honoured and supported when both Triffin and Van Lennep (and others including Johannes Witteveen) helped me in making FONDAD a successful policy research centre and international forum for policy discussion. It was a pity that the Dutch Ministry of Foreign Affairs stopped providing core funding to FONDAD in 2007. However, thanks to the enthusiasm and free of fee cooperation by members of the FONDAD Network we are still active. I am very grateful for that cooperation and hope it will contribute to preventing a next global financial crisis.

Thursday, November 16, 2017

Emmanuel Macron discredits his European project

It is interesting and important to follow what is happening in France. It is important for Europe as a whole and, consequently, for the world as a whole as Europe still plays an important role in the world. Here an article that praises and criticizes Macron.

On ne peut donc que se féliciter que notre nouveau président veuille secouer le cocotier européen en sortant la France d’une posture geignarde et repliée sur elle-même. Le souci, c’est qu’il y a une contradiction profonde entre les objectifs qu’Emmanuel Macron affiche pour sa politique européenne et celle qu’il mène en France même. Du côté du marché du travail, il entend en effet se battre contre le dumping social, comme sur la question du travail détaché, où il a obtenu le mois dernier que l’Europe aille (un petit peu) plus loin que prévu dans la modification des règles le concernant. Mais dans le même temps, dans l’Hexagone, il pousse au contraire les feux pour faciliter les licenciements et faire baisser le coût du travail. Une logique déflationniste qui plombe l’économie de la zone euro depuis quinze ans et menace la survie de nos systèmes sociaux, nourrissant l’euroscepticisme.

De même sur le terrain fiscal, avec la quasi-disparition de l’ISF, la forte baisse de l’imposition des revenus du capital et celle de l’impôt sur les bénéfices des entreprises, sa politique française consiste à engager vigoureusement le pays dans la course au moins-disant fiscal, qui aggrave les déficits des Etats de l’Union et dévalorise le projet européen en le faisant apparaître comme un moyen privilégié de creuser les inégalités. Et cela au moment où les temps semblaient (enfin) mûrs pour que s’engage, à l’échelle de l’Europe, une dynamique inverse d’harmonisation et de lutte contre le dumping fiscal. Bref, il y a malheureusement lieu de redouter que la politique française d’Emmanuel Macron décrédibilise ses projets européens, tant auprès des Français que de nos voisins.

Article publié sur Alternatives économiques le 1er novembre 2017. Soutenez les!

Contradiction

Emmanuel Macron a décidé de mettre l’Europe tout en haut de son agenda. D’ici à un an, il veut avoir créé une Europe de la défense, développé une politique numérique européenne, intégré davantage la zone euro… Tout cela pour que l’Europe protège mieux ses citoyens et cesse enfin d’être seulement cette Europe-marché sans âme qui a fait de la concurrence de tous contre tous sa principale raison d’être. Fort bien. C’était en effet un des principaux reproches qu’on pouvait adresser à François Hollande que d’avoir renoncé à toute ambition dans ce domaine.On ne peut donc que se féliciter que notre nouveau président veuille secouer le cocotier européen en sortant la France d’une posture geignarde et repliée sur elle-même. Le souci, c’est qu’il y a une contradiction profonde entre les objectifs qu’Emmanuel Macron affiche pour sa politique européenne et celle qu’il mène en France même. Du côté du marché du travail, il entend en effet se battre contre le dumping social, comme sur la question du travail détaché, où il a obtenu le mois dernier que l’Europe aille (un petit peu) plus loin que prévu dans la modification des règles le concernant. Mais dans le même temps, dans l’Hexagone, il pousse au contraire les feux pour faciliter les licenciements et faire baisser le coût du travail. Une logique déflationniste qui plombe l’économie de la zone euro depuis quinze ans et menace la survie de nos systèmes sociaux, nourrissant l’euroscepticisme.

De même sur le terrain fiscal, avec la quasi-disparition de l’ISF, la forte baisse de l’imposition des revenus du capital et celle de l’impôt sur les bénéfices des entreprises, sa politique française consiste à engager vigoureusement le pays dans la course au moins-disant fiscal, qui aggrave les déficits des Etats de l’Union et dévalorise le projet européen en le faisant apparaître comme un moyen privilégié de creuser les inégalités. Et cela au moment où les temps semblaient (enfin) mûrs pour que s’engage, à l’échelle de l’Europe, une dynamique inverse d’harmonisation et de lutte contre le dumping fiscal. Bref, il y a malheureusement lieu de redouter que la politique française d’Emmanuel Macron décrédibilise ses projets européens, tant auprès des Français que de nos voisins.

Article publié sur Alternatives économiques le 1er novembre 2017. Soutenez les!

Saturday, November 11, 2017

Jean-Claude Trichet and others on the danger of a new, dramatic global crisis

|

| Jean-Claude Trichet |

I sent the interview with Trichet to a Fondad Group of forty international experts on the global financial system (FG40) asking them for more in-depth analysis of the problem, and their view on how to improve the global financial system and prevent the emergence of a new, dramatic global crisis.

|

| Robert Aliber |

Christian Ghymers commented a few hours later: "As you know, we share Trichet's view and see also the next big(gest) crisis around the corner - and this time without rooms for manœuvre - except if the SDR could be effectively mobilized and transformed rapidly along the lines we try to push with Triffin Foundation (RTI) and our publications and interventions, in particular at the G20 Ministerial last year (see my PowerPoints attached) and in other joined short publications."

|

| Christian Ghymers |

|

| Andrew Sheng |

In a next post, I will highlight the views from the FG40 on how to prevent the emergence of a new, dramatic global crisis.

Memory, music and pleasure

Last night, driving back home from Groningen, I told my wife (Aafke Steenhuis) that my memory capacity is now better than when I was young, because I trained it in my work as a researcher, journalist and activist in the seventies and eighties, and as the director of FONDAD from 1987 until now.

After having moved the FONDAD office from The Hague to Amsterdam (in 2008) I trained my memory capacity even more during my morning walks to Schellingwoude Locks. In those walks, ideas sprang up that I tried to remember by memorizing the first word or phrase.

I continue to challenge my memory capacity when ideas come up in bed at night or in the early morning hours when I am writing about an idea and do not make a note of the other ideas that have sprung up. I try to memorize them and if I can not remember them later ... I treat them as unimportant ideas.

It's more than a trick. It is a pleasure.

PS: My father's band from the 1930s (he was about 20 years old) was called "Herman Tennyson and His Pleasure Providers". There is an old gramophone record (78 laps) of his band in which they play two pieces, "Tango des Roses" and "Marêva". Clicking on the link below you can hear the music of "Marêva" played by my father's band in the 1930s. My father plays the trumpet.

Tunquén and my father's band

Friday, October 20, 2017

Reconquer democracy at the national level to combat international neoliberalism

I have just read an interesting article on neoliberalism in Europe that

calls for restoring or regaining democratic debate at the national

level in European countries. I will cite paragraphs from the article,

written by William Mitchell and Thomas Fazi, which came out today in

Social Europe: "Everything You Know About Neoliberalism Is Wrong." Although I do not like the title of the article, I like the text.

"Even though neoliberalism as an ideology springs from a desire to curtail the state’s role, neoliberalism as a political-economic reality has produced increasingly powerful, interventionist and ever-reaching – even authoritarian – state apparatuses.

The process of neoliberalisation has entailed extensive and permanent state intervention, including: the liberalisation of goods and capital markets; the privatisation of resources and social services; the deregulation of business, and financial markets in particular; the reduction of workers’ rights (first and foremost, the right to collective bargaining) and more in general the repression of labour activism; the lowering of taxes on wealth and capital, at the expense of the middle and working classes; the slashing of social programmes, and so on. These policies were systemically pursued throughout the West (and imposed on developing countries) with unprecedented determination, and with the support of all the major international institutions and political parties.

(...) Conventional wisdom holds that globalisation and the internationalisation of finance have ended the era of nation states and their capacity to pursue policies not in accord with the diktats of global capital. But does the evidence support the assertion that national sovereignty has truly reached the end of its days? (...)

More in general, as we explain in our new book Reclaiming the State: A Progressive Vision of Sovereignty for a Post- Neoliberal World, globalisation, even in its neoliberal form, was (is) not the result of some intrinsic capitalist or technology-driven dynamic that inevitably entails a reduction of state power, as is often claimed. On the contrary, it was (is) a process that was (is) actively shaped and promoted by states. All the elements that we associate with neoliberal globalisation – delocalisation, deindustrialisation, the free movement of goods and capital, etc. – were (are), in most cases, the result of choices made by governments.

(...) [there was] a deliberate and conscious limitation of state sovereign rights by national elites, through a process known as depoliticisation. The various policies adopted by Western governments to this end include: (i) reducing the power of parliaments vis-à-vis that of the executive and making the former increasingly less representative (for instance by moving from proportional parliamentary systems to majoritarian ones); (ii) making central banks formally independent of governments; (iii) adopting ‘inflation targeting’ – an approach which stresses low inflation as the primary objective of monetary policy, to the exclusion of other policy objectives, such as full employment – as the dominant approach to central bank policymaking; (iv) adopting rules-bound policies – on public spending, debt as a proportion of GDP, competition, etc. – thereby limiting what politicians can do at the behest of their electorates; (v) subordinating spending departments to treasury control; (vi) re-adopting fixed exchange rates systems, such as the euro, which severely limit the ability of governments to exercise control over economic policy; (vii) limiting the capacity of governments to regulate in the public interest, by means of so-called ISDS (investor-state dispute settlement) mechanisms, nowadays included in most bilateral investment treaties (of which there are more than 4,000 in operation) and regional trade agreements (such as the FTAA and TPP); and, most importantly perhaps, (viii) surrendering national prerogatives to supranational institutions and super-state bureaucracies such as the EU.

(...) the creation of self-imposed ‘external constraints’ allowed national politicians to reduce the political costs of the neoliberal transition – which clearly involved unpopular policies – by ‘scapegoating’ institutionalised rules and ‘independent’ or international institutions, which in turn were presented as an inevitable outcome of the new, harsh realities of globalisation, thus insulating macroeconomic policies from popular contestation. The war on sovereignty has been in essence a war on democracy. This process was brought to its most extreme conclusions in Western Europe, where the Maastricht Treaty (1992) embedded neoliberalism into the EU’s very fabric, effectively outlawing the ‘Keynesian’ polices that had been commonplace in the previous decades.

(...) for more democratic control over politics (and particularly over the destructive global flows unleashed by neoliberalism), which necessarily can only be exercised at the national level, in the absence of effective supranational mechanisms of representation. The EU is obviously no exception: in fact, it is (correctly) seen by many as the embodiment of technocratic rule and elite estrangement from the masses, as demonstrated by the Brexit vote and the widespread euroscepticism engulfing the continent. In this sense, as we argue in the book, leftists should not see Brexit – and more in general the current crisis of the EU and monetary union – as a cause for despair, but rather as a unique opportunity to embrace (once again) a progressive, emancipatory vision of national sovereignty, to reject the EU’s neoliberal straitjacket and to implement a true democratic-socialist platform (which would be impossible within the EU, let alone within the eurozone). To do this, however, they must come to terms with the fact that the sovereign state, far from being helpless, still contains the resources for democratic control of a nation’s economy and finances – that the struggle for national sovereignty is ultimately a struggle for democracy. This needn’t come at the expense of European cooperation. On the contrary, by allowing governments to maximise the well-being of their citizens, it could and should provide the basis for a renewed European project, based on multilateral cooperation between sovereign states.

William

Mitchell and Thomas Fazi are the authors of Reclaiming the State: A Progressive Vision of Sovereignty for a Post- Neoliberal World, which

has just been published by Pluto Press.

|

| Thomas Fazi |

The process of neoliberalisation has entailed extensive and permanent state intervention, including: the liberalisation of goods and capital markets; the privatisation of resources and social services; the deregulation of business, and financial markets in particular; the reduction of workers’ rights (first and foremost, the right to collective bargaining) and more in general the repression of labour activism; the lowering of taxes on wealth and capital, at the expense of the middle and working classes; the slashing of social programmes, and so on. These policies were systemically pursued throughout the West (and imposed on developing countries) with unprecedented determination, and with the support of all the major international institutions and political parties.

(...) Conventional wisdom holds that globalisation and the internationalisation of finance have ended the era of nation states and their capacity to pursue policies not in accord with the diktats of global capital. But does the evidence support the assertion that national sovereignty has truly reached the end of its days? (...)

More in general, as we explain in our new book Reclaiming the State: A Progressive Vision of Sovereignty for a Post- Neoliberal World, globalisation, even in its neoliberal form, was (is) not the result of some intrinsic capitalist or technology-driven dynamic that inevitably entails a reduction of state power, as is often claimed. On the contrary, it was (is) a process that was (is) actively shaped and promoted by states. All the elements that we associate with neoliberal globalisation – delocalisation, deindustrialisation, the free movement of goods and capital, etc. – were (are), in most cases, the result of choices made by governments.

(...) [there was] a deliberate and conscious limitation of state sovereign rights by national elites, through a process known as depoliticisation. The various policies adopted by Western governments to this end include: (i) reducing the power of parliaments vis-à-vis that of the executive and making the former increasingly less representative (for instance by moving from proportional parliamentary systems to majoritarian ones); (ii) making central banks formally independent of governments; (iii) adopting ‘inflation targeting’ – an approach which stresses low inflation as the primary objective of monetary policy, to the exclusion of other policy objectives, such as full employment – as the dominant approach to central bank policymaking; (iv) adopting rules-bound policies – on public spending, debt as a proportion of GDP, competition, etc. – thereby limiting what politicians can do at the behest of their electorates; (v) subordinating spending departments to treasury control; (vi) re-adopting fixed exchange rates systems, such as the euro, which severely limit the ability of governments to exercise control over economic policy; (vii) limiting the capacity of governments to regulate in the public interest, by means of so-called ISDS (investor-state dispute settlement) mechanisms, nowadays included in most bilateral investment treaties (of which there are more than 4,000 in operation) and regional trade agreements (such as the FTAA and TPP); and, most importantly perhaps, (viii) surrendering national prerogatives to supranational institutions and super-state bureaucracies such as the EU.

(...) the creation of self-imposed ‘external constraints’ allowed national politicians to reduce the political costs of the neoliberal transition – which clearly involved unpopular policies – by ‘scapegoating’ institutionalised rules and ‘independent’ or international institutions, which in turn were presented as an inevitable outcome of the new, harsh realities of globalisation, thus insulating macroeconomic policies from popular contestation. The war on sovereignty has been in essence a war on democracy. This process was brought to its most extreme conclusions in Western Europe, where the Maastricht Treaty (1992) embedded neoliberalism into the EU’s very fabric, effectively outlawing the ‘Keynesian’ polices that had been commonplace in the previous decades.

(...) for more democratic control over politics (and particularly over the destructive global flows unleashed by neoliberalism), which necessarily can only be exercised at the national level, in the absence of effective supranational mechanisms of representation. The EU is obviously no exception: in fact, it is (correctly) seen by many as the embodiment of technocratic rule and elite estrangement from the masses, as demonstrated by the Brexit vote and the widespread euroscepticism engulfing the continent. In this sense, as we argue in the book, leftists should not see Brexit – and more in general the current crisis of the EU and monetary union – as a cause for despair, but rather as a unique opportunity to embrace (once again) a progressive, emancipatory vision of national sovereignty, to reject the EU’s neoliberal straitjacket and to implement a true democratic-socialist platform (which would be impossible within the EU, let alone within the eurozone). To do this, however, they must come to terms with the fact that the sovereign state, far from being helpless, still contains the resources for democratic control of a nation’s economy and finances – that the struggle for national sovereignty is ultimately a struggle for democracy. This needn’t come at the expense of European cooperation. On the contrary, by allowing governments to maximise the well-being of their citizens, it could and should provide the basis for a renewed European project, based on multilateral cooperation between sovereign states.

About William Mitchell and Thomas Fazi

|

| William Mitchell |

Wednesday, October 4, 2017

Electronic waste from the first world contaminates the blood of Africans

That our electronic waste contaminates the blood of poor Africans is a scandal. Here is an article about it, published on 21 September 2017 by Residuos Profesional and based on research by Universidad de Las Palmas de Gran Canaria (ULPGC) and the Hospital Insular, "Residuos electrónicos del primer mundo contaminan la sangre de los africano".

El trabajo apoya esa afirmación en varios datos estadísticos: los 16 países examinados están entre los más pobres del mundo, pero las concentraciones de esos metales son más altas entre los inmigrantes procedentes de naciones con más PIB, con más teléfonos por 100 habitantes, con más usuarios de internet y, sobre todo, con mayor volumen de importación de dispositivos electrónicos de segunda mano.

Por todo ello recomiendan hacer un mayor seguimiento de este tipo de contaminantes, porque “algunos de esos elementos comportan un enorme riesgo, sobre todo para los niños”, y porque “es bien sabido que la polución no respeta fronteras, así que el manejo inadecuado de esos los residuos tecnológicos en esos países puede producir un aumento generalizado de la presencia mundial de esos contaminantes”.

Fuente:

Efeverde

La sangre de los inmigrantes africanos que llegan a Canarias, con independencia de su país de origen, está contaminada por vanadio a niveles desconocidos en occidente y también por trazas de cobalto, arsénico, níquel… Es rastro de la basura tecnológica que el primer mundo envía a África.

(...)

Basura tecnológica

Los firmantes del artículo no tienen dudas respecto a qué se debe todo ello: se calcula, dicen, que el 80 % de la “basura tecnológica” genera el primer mundo se envía a África, tanto para abastecer el comercio de estos productos con modelos de segunda mano, muchas veces obsoletos y de vida muy corta, como para nutrir cadenas de reciclaje “informales” (eufemismo de insalubres o ilegales).El trabajo apoya esa afirmación en varios datos estadísticos: los 16 países examinados están entre los más pobres del mundo, pero las concentraciones de esos metales son más altas entre los inmigrantes procedentes de naciones con más PIB, con más teléfonos por 100 habitantes, con más usuarios de internet y, sobre todo, con mayor volumen de importación de dispositivos electrónicos de segunda mano.

Un ciudadano, un móvil

Los autores remarcan otro hecho: África puede estar atrasada respecto al resto del mundo en líneas telefónicas fijas, pero el uso del móvil se ha disparado en sus países en los últimos años, tanto las ciudades como las zonas rurales, hasta el punto de que muchos estados han alcanzado el paradigma de “un ciudadano, un móvil”. Eso sí, el 97 % de los móviles del continente son de segunda mano.Por todo ello recomiendan hacer un mayor seguimiento de este tipo de contaminantes, porque “algunos de esos elementos comportan un enorme riesgo, sobre todo para los niños”, y porque “es bien sabido que la polución no respeta fronteras, así que el manejo inadecuado de esos los residuos tecnológicos en esos países puede producir un aumento generalizado de la presencia mundial de esos contaminantes”.

Fuente:

Efeverde

Wednesday, September 27, 2017

Secret EU memorandum on the privatisation of water in Greece

|

| Painting of Thessaloniki by Aafke Steenhuis |

Leaked EU Memorandum Reveals Renewed Attempt at Imposing Water Privatization on Greece

Tuesday, August 25, 2015 By Satoko Kishimoto and Olivier Hoedeman, Corporate Europe Observatory | News AnalysisThe requirement to sell off €50 billion in public assets is one of the most controversial aspects of the 'agreement' that Eurozone countries and the Troika forced on the Greek government during mid-July's "night of shame".

Details of exactly what Greece is required to privatise have now emerged with the leaking of the "Memorandum of Understanding for a three-year ESM programme" prepared by the Troika's International Monetary Fund, European Commission and European Central Bank. [1] The leaked document lists 23 state assets, ranging from airports to service utilities, and presents precise steps and timelines for privatisation.

It comes as a shock that this list includes two large public water companies: Athens Water Supply & Sewerage S.A (EYDAP) and Thessaloniki Water Supply & Sewerage S.A. (EYATH), which provide drinking water for the country's two biggest cities. The Troika had insisted on water privatisation in an earlier memorandum, but strong public opposition had blocked this proposal.

In June 2014 the Council of State, the country's highest administrative court, ruled that transferring a controlling stake in Athens' public water utility EYDAP to private hands was unconstitutional because of the responsibility of the state to protect citizens' fundamental right to health. [2] The new Memorandum foresees the sale of 11% of EYDAP shares, which seems minimal at face value, but given that 38.7% of EYDAP's shares are already owned by private companies and individuals, it would leave 49.7% of the utility in private hands.

As for Thessaloniki, a non-binding referendum was held in May 2014, resulting in a 98% vote against water privatisation. This citizen-led initiative mobilised 218,002 voters and sent a crystal clear message rejecting the planned sale of 51% of EYATH shares to private investors (French water multinational Suez and Israel's state-owned Merokot had shown interest). The leaked Memorandum now orders the liquidation of 23% of state-owned shares; knowing that another 26% are already in private hands, this would make the company 49% private.

- to read further click HERE

Friday, September 22, 2017

Dani Rodrik, Barry Eichengreen and Paul Craig Roberts

|

| Trump's UN speech |

There are articles that you may like to read or read already such as these two by authors who belong to the FONDAD Network:

"Macron’s Labour Gambit" by Dani Rodrik At the end of August, French president Emmanuel Macron unveiled the labour-market overhaul that will make or break his presidency – and may well determine the future of the eurozone. His goal is to bring down France’s stubbornly high rate of unemployment, just a shade below 10%, and energize an economy that badly needs a […]

read more...

"The Euro’s Narrow Path" by Barry Eichengreen With Emmanuel Macron’s victory in the French presidential election, and Angela Merkel’s Christian Democratic Union enjoying a comfortable lead in opinion polls ahead of Germany’s general election on September 24, a window has opened for eurozone reform. The euro has always been a Franco-German project. With a dynamic new leader in one country and a […]

read more...

And there are also articles you are not interested in because they are authored by someone you do not know, mistrust or dismiss. This may be the case with Paul Graig Roberts. Do you know who he is and what articles and books he has published? If not, you may like to read one of his latest articles, Trump’s UN Speech.

If you don't like this article or disagree with it, I wonder why and on what facts your opinion is based.

I noticed that I tended to dismiss Paul Graig Roberts' opinion after I had read on internet certain things of and about him that give reason to dismiss his opinion. But I realized this is unfair because the fact that he has written articles I do not agree with is not a good reason to dismiss other, sensible, articles by him.

Many of the things Roberts says in his article about Trump's UN speech I find sensible. There are also some things I disagree with or wonder whether he is (fully) right such as his statement or suggestion that the US "war on terror" has resulted in 'tens of millions of slaughtered, maimed, and displaced persons'.

However, it is interesting to investigate what is true and not true in this and other statements by Paul Graig Roberts.

One, positive, reviewer (Edward Curtin) of a recent book authored by Roberts, The Neoconservative Threat to World Order, says about him: A former Assistant Secretary of the Treasury for Economic Policy in the Reagan administration and an editor and columnist for the Wall Street Journal, Paul Craig Roberts has escaped all easy labels to become a public intellectual of the highest order. He is a prolific critic of U.S. foreign and domestic policies, with a special emphasis on the nefarious influence of the neoconservatives from the Reagan through the Obama administrations. A savage critic of the mainstream corporate media – he calls them “presstitutes” – he dissects their propaganda and disinformation like a truth surgeon and penetrates to the heart of issues in a flash.

Friday, September 8, 2017

Macron wants debt relief for Greece and warns about China's presence in Europe

|

Piraeus: A gateway for China's New Silk Road into Europe |

Does Macron also want less influence for China in Europe, given his warnng that China (Cosco) already took posession of the main part of the Port of Piraeus (see last paragraph in the article below)? Here you can see a short video I made last year about China taking control of the Port of Piraeus: The Port of Piraeus

Pour Macron, la dette grecque doit être renégociée

7 septembre 2017

Le

président français a prononcé jeudi un discours sur la démocratie

européenne à Athènes. Mais en arrière-plan de sa visite, un sujet

principal: la dette grecque et l’Allemagne

Comme conseiller à l’Elysée à partir de juin 2012, puis comme ministre, le chef de l’Etat français a toujours plaidé pour une restructuration (le fameux «haircut») de la dette publique grecque, qui se maintient depuis 2011 à plus de 170% du produit intérieur brut, aux alentours de 350 milliards d’euros. Son point de vue, selon son entourage, reste inchangé: «C’est la position de la France. Elle est connue. Il faudra mettre le sujet sur la table et l’aborder avant l’été 2018, qui marquera la fin du troisième plan d’aide européen», confirme-t-on à l’Elysée.

(...)

Sur la dette grecque, Paris estime que le moment est mûr pour bouger. «On a de plus en plus confiance sur la reprise de l’économie grecque et sur la capacité du pays à passer à quelque chose de nouveau. Nous n’avons pas de raisons de penser que le plan grec va déraper dans cette dernière ligne droite. Il est de l’intérêt collectif que les autorités helléniques puissent passer à une nouvelle phase», souligne-t-on à l’Elysée. Le troisième plan d’aide grec, approuvé en mai 2016, porte sur un montant total de prêts de 10,3 milliards d’euros, dont le versement a été achevé en juillet par le Mécanisme européen de stabilité basé à Luxembourg.

Se protéger des racheteurs extra-européens

La question qui pose problème aujourd’hui, pour aborder la réduction de la dette, est selon la France celle des «investissements stratégiques», un terme qui désigne le processus de privatisation et la revente d’actifs publics à des entreprises contrôlées par des puissances extérieures à l’UE telles que la Chine. «Il nous faut maintenant d’urgence construire des consortiums européens pour éviter que l’on ne se retrouve devant une autre cession problématique, comme celle d’une partie du port du Pirée (rachetée en janvier 2016 par le géant Cosco) aux Chinois», plaide-t-on du côté français. (...)Wednesday, September 6, 2017

Four Lessons For Europe From Italy’s Experience With Populism

Four Lessons For Europe From Italy’s Experience With Populism

by Giuliano Bobba on

Giuliano Bobba

Interestingly, if one looks closely enough, they can identify some common patterns characterising the emergence of populist parties in Italy. In the early 1990s, the rise of Forza Italia (FI) and the Lega Nord (LN – Northern League) was closely tied to political and economic crises. In a similar fashion, since 2008 a new period of economic and political crisis has coincided with the ascent of Beppe Grillo’s Five Star Movement. Italy thus offers a useful case study for assessing the consequences that are implied by a continuous and strong populist presence in national politics. If we look across these years as a whole, the Italian experience highlights four particular threats to democracy that can emerge from this populist presence.

First, there have been implications for the checks and balances that exist within the Italian political system. Populist parties have repeatedly attacked the work of judges, notably in the case of Silvio Berlusconi. They have also had a sizeable impact on the role of the media in Italian politics. This is true both of Berlusconi’s Forza Italia and the Five Star Movement, who have both posed a threat to the freedom and autonomy of media organisations.

Second, there has been a general oversimplification of political discourse in Italy. The debate about the cost of politics is a good example. Initially introduced by the Northern League and Forza Italia in the 1990s, complaints over the cost of politics have also become one of the most successful topics for Beppe Grillo to mobilise support around. Yet despite the presence of this debate for two decades in Italian politics, the political attention it has received has failed to produce significant savings (as shown, for instance, by several expensive and incomplete attempts to abolish provincial councils). There is cross-party consensus among the main political parties on the need to reduce the number of MPs. This implies a certain reduction of political representation, while the reduction in terms of the cost of politics is rather uncertain.

Third, Italy has experienced the spread of populist themes and frames even among non-populist parties. In the last few years, the success of populist campaigning among citizens has pushed even mainstream parties to react using populist rhetoric, styles and sometimes also populist content of their own. An example would be a much-shared Facebook post produced by Matteo Renzi on migration, which stated that ‘we need to free ourselves from a sense of guilt. We do not have the moral duty to welcome into Italy people who are worse off than ourselves’.

Finally, Italian populism illustrates the so called ‘cultivation theory’. To paraphrase George Gerbner and his colleagues, instead of ‘growing up with television’ we might address the issue of ‘growing up with populism’. Italy is now characterised by general discontent among citizens and strong political disaffection. The country is not an exception in this respect among Southern European countries and, obviously, the blame for this situation cannot be attributed solely to populist parties. Nevertheless, it is worth noting that, at least in part, the success of populist parties is achieved through the de-legitimisation of politics, institutions, and the ruling class, and that it produces a vicious circle fuelling citizens’ distrust and dissatisfaction.

Although populist parties can pose threats of this nature to democracy, usually their leaders are also political entrepreneurs that build off several problems not adequately addressed by mainstream parties. Their successes, indeed, rely on the ineffectiveness of governments to take seriously the problems identified by populist parties, such as political corruption, inefficient use of public money, the integration of migrants, and the demands of those who are excluded from the benefits of the globalisation process. Finding viable solutions to these issues is the obligatory path for Italian politics to follow if it is to reduce the growing gap that separates it from Italian citizens.

First published by LSE Europp blog

About Giuliano Bobba

Giuliano

Bobba is Assistant Professor at the University of Turin. His research

interests include relationships between governments, parties and the

media; election campaigns at the European, national and local levels;

the European public sphere; and populism.

Sunday, September 3, 2017

How Fares Emmanuel Macron?

Below you can read two articles about French president Emmanuel Macron:

Trade unions protested in Paris on August 31 as President Emmanuel Macron unveiled his new attacks on workers’ rights, the Morning Star said the next day. Macron’s proposed labour “reforms” would make it easier for bosses to hire and fire workers.

Macron wants parliament to vote on the new legislation — the third attack on workers’ rights in the past few years — without a chance to amend it.

The country’s labour code is seen by the neoliberal president as the major cause of joblessness in France. However, other large European countries such as Italy and Spain, with fewer protections for workers, have higher rates of unemployment.

The protest against the reforms was called by union federations CGT and Solidaires, Right to Housing and Attac France in the Parisian suburb of Jouy-en-Josas.

“Mr Macron represents the big bosses, and those who want to cut public services, social protection and everything achieved by workers,” one protester said.

The unions have called for mass demonstrations against the new law on September 12, but two of France’s biggest unions, the Force Ouvriere and CFDT, have said they will not take part. Jean-Luc Melenchon, leader of left-wing party France Unbowed, has called a further protest on September 23.

Published in www.greenleft.org.au

POPULARITÉ - Le mois d'août fut morose, la

rentrée n'est guère plus réjouissante. La cote de popularité du couple

exécutif poursuit sa chute vertigineuse. Selon notre baromètre mensuel réalisé par YouGov pour Le HuffPost et CNews, Emmanuel Macron

voit son image se dégrader pour le deuxième mois consécutif dans

l'opinion. Sa cote de confiance perd 6 points en septembre pour

atteindre 30% d'opinions favorables après en avoir perdu 7 au mois d'août.

Un désamour qui justifie amplement le changement de stratégie de

communication de l'Elysée. Mais celui-ci n'a pour l'heure pas eu le

temps d'infuser dans l'opinion. Il faudra attendre le mois d'octobre

pour déterminer si l'hémorragie a été enrayée.

En plein débat sur la réforme du code du travail,

c'est du côté des électeurs socialistes (-8 points) et d'extrême gauche

(-7 points) que la baisse est la plus notable. Mais le coeur de cible

électoral du président n'échappe pas à la décrue: le chef de l'Etat perd

encore 6 points chez les électeurs du centre. A l'inverse, Emmanuel

Macron regagne 6 points chez les sympathisants Les Républicains (à 45%

d'opinions favorables), preuve que les réformes libérales et les coupes

budgétaires ordonnées par l'exécutif ne déplaisent pas à tout le monde. ... (to read further, click the title of the article)

France: Macron unveils assault on workers’ rights

Macron wants parliament to vote on the new legislation — the third attack on workers’ rights in the past few years — without a chance to amend it.

The country’s labour code is seen by the neoliberal president as the major cause of joblessness in France. However, other large European countries such as Italy and Spain, with fewer protections for workers, have higher rates of unemployment.

The protest against the reforms was called by union federations CGT and Solidaires, Right to Housing and Attac France in the Parisian suburb of Jouy-en-Josas.

“Mr Macron represents the big bosses, and those who want to cut public services, social protection and everything achieved by workers,” one protester said.

The unions have called for mass demonstrations against the new law on September 12, but two of France’s biggest unions, the Force Ouvriere and CFDT, have said they will not take part. Jean-Luc Melenchon, leader of left-wing party France Unbowed, has called a further protest on September 23.

Published in www.greenleft.org.au

EXCLUSIF - La popularité de Macron dégringole encore en septembre

Dans notre baromètre mensuel YouGov, le couple exécutif voit son image se dégrader une nouvelle fois à la rentrée après un été compliqué.

04/09/2017 05:00 CEST

|

Actualisé

il y a 1 heure

-

Geoffroy Clavel Chef du service politique du HuffPost

Charles Platiau / Reuters

Après un été difficile, la cote de popularité du

président Macron chute encore de 6 points dans notre baromètre YouGov.

Sunday, July 23, 2017

"The EU is a neoliberal project..."

You may find this article in the New Statesman interesting:

20 July 2017

Lexit: the EU is a neoliberal project, so let's do something different when we leave it

Brexit affords the British left a historic opportunity for a decisive break with EU market liberalism.

By Joe Guinan and Thomas M Hanna

The Brexit vote to leave the European Union has many parents, but

"Lexit" – the argument for exiting the EU from the left – remains an

orphan. A third of Labour voters backed Leave, but they did so without

any significant leadership from the Labour Party. Left-of-centre votes

proved decisive in determining the outcome of a referendum that was

otherwise framed, shaped, and presented almost exclusively by the right.

A proper left discussion of the issues has been, if not entirely

absent, then decidedly marginal – part of a more general malaise when it

comes to developing left alternatives that has begun to be corrected

only recently, under Jeremy Corbyn and John McDonnell.

Ceding Brexit to the right was very nearly the most serious strategic mistake by the British left since the ‘70s. Under successive leaders Labour became so incorporated into the ideology of Europeanism as to preclude any clear-eyed critical analysis of the actually existing EU as a regulatory and trade regime pursuing deep economic integration. The same political journey that carried Labour into its technocratic embrace of the EU also resulted in the abandonment of any form of distinctive economics separate from the orthodoxies of market liberalism.

It’s been astounding to witness so many left-wingers, in meltdown over Brexit, resort to parroting liberal economics. Thus we hear that factor mobility isn’t about labour arbitrage, that public services aren’t under pressure, that we must prioritise foreign direct investment and trade. It’s little wonder Labour became so detached from its base. Such claims do not match the lived experience of ordinary people in regions of the country devastated by deindustrialisation and disinvestment.

Nor should concerns about wage stagnation and bargaining power be met with finger-wagging accusations of racism, as if the manner in which capitalism pits workers against each other hasn’t long been understood. Instead, we should be offering real solutions – including a willingness to rethink capital mobility and trade. This places us in direct conflict with the constitutionalised neoliberalism of the EU. ...

Read full article HERE

Ceding Brexit to the right was very nearly the most serious strategic mistake by the British left since the ‘70s. Under successive leaders Labour became so incorporated into the ideology of Europeanism as to preclude any clear-eyed critical analysis of the actually existing EU as a regulatory and trade regime pursuing deep economic integration. The same political journey that carried Labour into its technocratic embrace of the EU also resulted in the abandonment of any form of distinctive economics separate from the orthodoxies of market liberalism.

It’s been astounding to witness so many left-wingers, in meltdown over Brexit, resort to parroting liberal economics. Thus we hear that factor mobility isn’t about labour arbitrage, that public services aren’t under pressure, that we must prioritise foreign direct investment and trade. It’s little wonder Labour became so detached from its base. Such claims do not match the lived experience of ordinary people in regions of the country devastated by deindustrialisation and disinvestment.

Nor should concerns about wage stagnation and bargaining power be met with finger-wagging accusations of racism, as if the manner in which capitalism pits workers against each other hasn’t long been understood. Instead, we should be offering real solutions – including a willingness to rethink capital mobility and trade. This places us in direct conflict with the constitutionalised neoliberalism of the EU. ...

Read full article HERE

Thursday, July 6, 2017

"Our democracy is under siege by the plutocratic elite"

Here is a speech that might inspire policymakers in countries that aim at putting markets under strict democratic control to avoid monopolies, booms and busts and extreme concentration of wealth. The speech was published by Social Europe. The author quotes a Swedish social democrat who once said: “The market is a useful servant, but an intolerable

master”. He stresses that "underlying the demise of neoliberalism is a financial system out of control."

The neoliberal era started in the eighties as a revolt against the

welfare state. It was a reassertion of the fundamentalist belief in

market infallibility. It turned out to be a repeat version of history:

Essentially it leads to casino capitalism, in the thrall of

high finance, just as in the stock exchange crash in 1929.

Austerity-like policies to deal with the consequences deepened the

crisis, then as now, and ended in a decade-long Great Depression.

The bankruptcy of Lehman Brothers in 2008 signified the end of that neoliberal era. Once more, this version of unregulated capitalism crashed. It ended in the biggest rescue operation by the state in history. Stimulus packages by the state and quantitative easing (printing money) by central banks on a massive scale rescued us from a new Great Depression.

Instead, we are now experiencing the Great Recession. What is the difference? A massive bail-out of the financial system by tax-payers. Once again, unregulated capitalism had to be saved from the capitalists – by the state. This has revealed neoliberalism to be what it is: pseudo-science in the service of the super-rich. Just like Soviet communism it is a fundamentalist dogma, which has utterly failed the test of implementation. And in so far as it is in the service of privileged elites and rejects the role of the democratic state in taking care of the public interest it is in essence anti-democratic.

This is many times more than in any other sectors, although managing money creates no comparable value. As such, this financial system has turned out to be the main conduit for moving streams of income and wealth from the productive sectors of society to the financial elite: from the 99% to the 1%. The share of labor in global GDP has fallen by hundreds of billions annually, while the share of income/wealth enriching the 1% has increased dramatically.

Small and medium-sized companies (SMEs) account for 67% of job creation in our societies, but receive only a fraction of total bank lending. In their single-minded pursuit of short-term profit the banks concentrate their lending on stock exchange speculation and real estate, increasing the nominal value of existing assets – creating bubbles and busts – and further enriching the rich.

This is why inequality has reached exorbitant levels in our societies. The rich are getting richer and the poor are getting poorer by the day. This is why long-term unemployment is built into the system. This is why poverty is increasing amidst plenty. This is why social cohesion is dwindling and polarisation growing. Since our leaders seem to be offering no convincing solutions, feelings of disappointment, resentment, anger and distrust are rising. Our democracy is under siege by the plutocratic elite.

What is our social democratic response to this existentialist crisis of unregulated capitalism? The basic elements of the Nordic model took shape as a response to the great socio-economic upheavals of the interwar period of the last century. In the West we observed the market failure of unregulated capitalism and the Great Depression. In the East we observed the Soviet experiment with communism: a centralized command economy run by a police state, which enforced the abolition of human rights, democracy and the rule of law.

We rejected both. We decided that we would follow the third way. We recognized the usefulness of a competitive market system, where applicable, to allocate resources and create wealth. But we put markets under strict democratic control to avoid market distortions (monopolies, booms and busts and extreme concentration of wealth). We insisted on public provision of education, healthcare and general utilities (energy, water, public transport, etc).

The means are familiar. Social insurance (sickness, accident, old age, and unemployment insurance), free access to quality healthcare and education, paid for by progressive taxation; active labour market policy to get rid of unemployment; and provide affordable housing for all. We emphasize equality of the sexes and strong support for families with children. These are redistributive policies aimed at increasing equality and social mobility – as a matter of human rights not as charity.

The result is a society where equality of income and wealth is greater than elsewhere. This means that individual freedom is not a privilege of the few, but a matter of emancipation for the many. Social mobility – the ability to advance in society, if you work hard and play by the rules – is de facto greater in the Nordic countries than elsewhere. The Nordic model has by now replaced the United States of America as the land of opportunity.

This is the only socio-economic model, emerging in the last century, that has withstood the test of time in the era of globalization in the 21st century.

Now we know better. The facts speak for themselves. No matter what criteria we apply, the Nordic model is invariably at the top of the league.

This applies no less to economic performance than other criteria: Economic growth, research and developement, technological innovation, productivity per hour of work, job creation, participation in the labour market, (especially women), equality of the sexes, level of education, social mobility, absence of poverty, health and longevity, quality of infrastructure, access to unspoilt nature, the overall quality of life. Less inequality than in most places. And a vibrant democracy. What more do you want?

What tasks lie ahead? An all-out effort against the financial elite to restrain the forces of inequality and to reclaim the power of democracy. An unyielding solidarity with Europe’s youth, who have been left to fend for themselves in the queues of the unemployed, bereft of hope. And take up the fight for the preservation of the environment and our common future on this planet.

There are three major challenges that lie ahead in the immediate and near future:

These three major problems, as well as relevant solutions, are inter-related.. A precondition for success in meeting them is a political alliance between social democrats, trade unions, environmentalists and the radical left among Europe´s neglected youth. The road signs are already there.

Remember the motto of Tage Erlander, the long-time leader of Sweden’s social democrats, and arguably the greatest reformer of the last century. He said: “The market is a useful servant, but an intolerable master”. And the spiritual leader of the Catholic faith, Pope Francis, agreed, when he said:

What Can We Learn From The Nordic Model?

by Jón Baldvin Hannibalsson on

Jón Baldvin Hannibalsson

The bankruptcy of Lehman Brothers in 2008 signified the end of that neoliberal era. Once more, this version of unregulated capitalism crashed. It ended in the biggest rescue operation by the state in history. Stimulus packages by the state and quantitative easing (printing money) by central banks on a massive scale rescued us from a new Great Depression.

Instead, we are now experiencing the Great Recession. What is the difference? A massive bail-out of the financial system by tax-payers. Once again, unregulated capitalism had to be saved from the capitalists – by the state. This has revealed neoliberalism to be what it is: pseudo-science in the service of the super-rich. Just like Soviet communism it is a fundamentalist dogma, which has utterly failed the test of implementation. And in so far as it is in the service of privileged elites and rejects the role of the democratic state in taking care of the public interest it is in essence anti-democratic.

Dying neoliberalism

Underlying the demise of neoliberalism is a financial system out of control. In the years 1980-2014 the financial system grew six times faster than the real economy. The fundamentalist belief driving it is that the sole duty of corporate CEOs is to maximize short-term profits, share prices and dividends. Those perverse incentives are used to justify executive salaries more than 300 times higher than those of average workers; and obscene bonuses.This is many times more than in any other sectors, although managing money creates no comparable value. As such, this financial system has turned out to be the main conduit for moving streams of income and wealth from the productive sectors of society to the financial elite: from the 99% to the 1%. The share of labor in global GDP has fallen by hundreds of billions annually, while the share of income/wealth enriching the 1% has increased dramatically.

Small and medium-sized companies (SMEs) account for 67% of job creation in our societies, but receive only a fraction of total bank lending. In their single-minded pursuit of short-term profit the banks concentrate their lending on stock exchange speculation and real estate, increasing the nominal value of existing assets – creating bubbles and busts – and further enriching the rich.

This is why inequality has reached exorbitant levels in our societies. The rich are getting richer and the poor are getting poorer by the day. This is why long-term unemployment is built into the system. This is why poverty is increasing amidst plenty. This is why social cohesion is dwindling and polarisation growing. Since our leaders seem to be offering no convincing solutions, feelings of disappointment, resentment, anger and distrust are rising. Our democracy is under siege by the plutocratic elite.

Footloose finances and solidarity

This unsustainable financial system is footloose and fickle and prone to panic at the slightest sign of trouble, leaving behind scorched earth: collapsed currencies, bankrupted banks, sovereign defaults and mountains of debt to be paid by others. There is a complete disconnect between freedom and responsibility. After the crash of 2008 the system has been rebuilt on the same model. That means that we are stuck in a prolonged recession, even awaiting a new crisis. The people out there, who are suffering the consequences, are waiting for trustworthy solutions – radical reform.What is our social democratic response to this existentialist crisis of unregulated capitalism? The basic elements of the Nordic model took shape as a response to the great socio-economic upheavals of the interwar period of the last century. In the West we observed the market failure of unregulated capitalism and the Great Depression. In the East we observed the Soviet experiment with communism: a centralized command economy run by a police state, which enforced the abolition of human rights, democracy and the rule of law.

We rejected both. We decided that we would follow the third way. We recognized the usefulness of a competitive market system, where applicable, to allocate resources and create wealth. But we put markets under strict democratic control to avoid market distortions (monopolies, booms and busts and extreme concentration of wealth). We insisted on public provision of education, healthcare and general utilities (energy, water, public transport, etc).

The means are familiar. Social insurance (sickness, accident, old age, and unemployment insurance), free access to quality healthcare and education, paid for by progressive taxation; active labour market policy to get rid of unemployment; and provide affordable housing for all. We emphasize equality of the sexes and strong support for families with children. These are redistributive policies aimed at increasing equality and social mobility – as a matter of human rights not as charity.

The result is a society where equality of income and wealth is greater than elsewhere. This means that individual freedom is not a privilege of the few, but a matter of emancipation for the many. Social mobility – the ability to advance in society, if you work hard and play by the rules – is de facto greater in the Nordic countries than elsewhere. The Nordic model has by now replaced the United States of America as the land of opportunity.

This is the only socio-economic model, emerging in the last century, that has withstood the test of time in the era of globalization in the 21st century.

Why the Nordic model works

The neoliberal creed is that the welfare state, with its high progressive taxes and strong public sector, is uncompetitive. State intervention hampers growth and innovation and results in stagnation. The bottom line: owing to its lack of dynamism, the welfare state is said to be unsustainable in the long run. And the proliferation of state bureaucracy is even said to threaten individual freedom and ultimately end in a totalitarian state (Hayek).Now we know better. The facts speak for themselves. No matter what criteria we apply, the Nordic model is invariably at the top of the league.

This applies no less to economic performance than other criteria: Economic growth, research and developement, technological innovation, productivity per hour of work, job creation, participation in the labour market, (especially women), equality of the sexes, level of education, social mobility, absence of poverty, health and longevity, quality of infrastructure, access to unspoilt nature, the overall quality of life. Less inequality than in most places. And a vibrant democracy. What more do you want?

What tasks lie ahead? An all-out effort against the financial elite to restrain the forces of inequality and to reclaim the power of democracy. An unyielding solidarity with Europe’s youth, who have been left to fend for themselves in the queues of the unemployed, bereft of hope. And take up the fight for the preservation of the environment and our common future on this planet.

There are three major challenges that lie ahead in the immediate and near future:

- Sanitise the corrupt financial system and put it back firmly under democratic control

- Massive investment in clean and renewable energy to replace fossil fuels as the life-blood of our economies. This is an urgent task which calls for social democrats and environmentalists to work together to save our planet

- Start planning now how to tackle the consequences of the technological revolution which is ongoing all around us (IT, digitization and automation)

These three major problems, as well as relevant solutions, are inter-related.. A precondition for success in meeting them is a political alliance between social democrats, trade unions, environmentalists and the radical left among Europe´s neglected youth. The road signs are already there.

Remember the motto of Tage Erlander, the long-time leader of Sweden’s social democrats, and arguably the greatest reformer of the last century. He said: “The market is a useful servant, but an intolerable master”. And the spiritual leader of the Catholic faith, Pope Francis, agreed, when he said:

The worship of the golden calf of old has found a new and heartless image in the cult of money and the dictatorship of financial markets, which are faceless and lacking any humane goal. Money has to serve, not rule.This is an edited version of a speech given at the celebratory 120th anniversary of the Lithuanian Social-Demcorati Party in Vilnius.

Sunday, May 21, 2017

Charles Wyplosz: "Wolfgang Schaüble is a criminal"

The Swiss newspaper Le Temps published on 21 May 2017 an interesting interview with Charles Wyplosz, who argues that Wolfgang Schaüble is a criminal.

Charles

Wyplosz, professeur d’économie à l’IHEID de Genève, constate que la

reprise économique en Europe est réelle, mais reste fragile. Il accuse

la politique d’austérité imposée par le ministre allemand des Finances

d’avoir créé plusieurs millions de chômeurs européens

– Un climat d’optimiste se ressent lorsque le chômage

descend et les consommateurs achètent. C’est le cas à présent. Seul

bémol: la situation politique reste difficile, sauf pour l’Allemagne.

Nous constatons que c’est la fin des partis conservateurs et

anti-marchés.

Avec l’élection de Trump et le vote en faveur du Brexit, les citoyens américains et britanniques réalisent qu’elles ont créé des situations difficiles. Les résultats de récentes élections aux Pays-Bas, en Autriche et tout récemment en France, montrent que les frustrations refluent. J’espère que cette tendance se poursuivra en Italie où le Mouvement 5 étoiles, même s’il n’est pas ouvertement raciste, garde un pouvoir de séduction.

– Puisque les cycles économiques sont de plus en plus de courte durée, faut-il craindre un retournement rapide de la conjoncture?

– Non. Les cycles sont plutôt longs. Nous avons traversé, au début des années 2000, une longue période de croissance soutenue. Par la suite, il y a eu un effondrement, mais il a été bref grâce à l’intervention des banques centrales qui ont agi avec une force inhabituelle. Nous sommes maintenant dans une phase post-crise qui est assez longue.

– Donc tout va bien?

– Pour l’Europe, le cycle vient de démarrer, en 2013-2014. A ce stade, il est loin d’arriver à maturation. Il peut continuer deux à trois ans. Aux Etats-Unis, le chômage est très bas et l’inflation commence à apparaître. On peut s’attendre à un retournement dans deux ans.

Cela dépend aussi de ce que le président Trump fera en politique économique. Son plan de relance de 1000 milliards de dollars ne se matérialisera probablement pas. Et on attend toujours ses cadeaux fiscaux aux entreprises. Cela dit, il n’y a pas deux cycles qui se ressemblent. Depuis 1945, ils durent en moyenne cinq à six ans.

– Pour revenir à la crise dans la zone euro, vous disiez que les Européens ont trop tergiversé avant d’agir…

– La Banque centrale européenne (BCE) a assez mal réagi dans un premier temps. Elle ne s’est pas rendu compte qu’on allait vers une récession. Il y a eu par la suite une crise des dettes publiques. On a perdu deux à trois ans. Un changement de leadership est intervenu à la BCE et les nouveaux dirigeants ont compris les enjeux. La banque centrale est alors intervenue puissamment et lourdement avec une politique d’assouplissement monétaire et une communication efficace.

Du coté des gouvernements, en 2008, le G8 s’était réuni d’urgence aux Etats-Unis et avait recommandé une politique expansionniste urgente. A l’exception de la Chine et du Japon, personne n’a agi de façon significative. Bruxelles a même imposé une politique d’austérité, ce qui a donné lieu à une deuxième récession en 2011-2012. Les Etats européens sont toujours paralysés par le Pacte de stabilité, qui ne convient pas dans une période de crise. Et encore, la Commission Juncker a été plus souple que celle de Barroso qui n’a pas su prendre de la distance avec Wolfgang Schäuble, le ministre allemand des Finances.

– En quoi Wolfgang Schäuble est-il concerné?

– Il est responsable d’une politique d’austérité en Europe qui a créé plusieurs millions de chômeurs. C’est criminel. La Commission a obéi à ses ordres. Le ministre allemand aurait dû comprendre que l’Europe était dans une situation de crise historique et que la priorité n’était pas de réduire les déficits, mais de créer des emplois. Il fallait tirer les leçons de la Grande dépression des années trente. Alors que la crise battait son plein, le président américain Hoover disait que l’État devait donner l’exemple et se serrer la ceinture. C’était le contraire qu’il fallait faire.

– Est-ce qu’on n’attend pas trop de l’Allemagne en lui demandant de réduire ses excédents budgétaires et commerciaux?

– Je ne suis pas convaincu qu’il faille faire des reproches à Berlin sur ces points. L’impact sur l’Europe d’une relance budgétaire en Allemagne serait limité. Cela consisterait à dire aux Allemands d’accumuler des déficits et des dettes pour nous faire plaisir. Si j’étais un contribuable allemand, je ne serais pas d’accord. Du reste, ce sont le secteur privé, les entreprises et les ménages allemands, qui sont les grands épargnants. L’épargne est une affaire personnelle et ce n’est pas à l’État d’y intervenir.

En revanche, les Allemands ont tort de ne pas profiter des taux d’intérêt bas pour investir. Financièrement et logiquement, ce serait une bonne affaire. Les livres d’histoire reprocheront aux décideurs allemands leur vision frigorifiée. Ils pensent toujours à tort que les Chinois vont continuer à leur acheter des Mercedes et que cela leur suffit.

– Mario Draghi, président de la BCE, a annoncé la fin de son programme d’assouplissement monétaire pour décembre 2017. Est-ce le bon timing?

– Ses propos sont plus nuancés. Il a certes parlé de décembre, mais en réalité, il a dit qu’il pourrait le poursuivre si la situation l’exigeait.

– Le Fonds monétaire international vient une nouvelle fois d’affirmer que les banques européennes n’ont pas fini de nettoyer leur bilan. Représentent-elles toujours un risque systémique?

– Il y a un problème massif non résolu en Italie. Les Italiens n’ont pas fait leur part de nettoyage des actifs pourris, ce qu’ils auraient dû faire il y a déjà cinq ans. Les Espagnols l’ont fait. J’ai des doutes pour les Français. Enfin, on verra comment les Allemands vont résoudre le problème avec la Deutsche Bank. Bref, la zone euro cache encore des cadavres. Si la croissance s’installe, tout sera pardonné. S’il y a une crise en Italie, ce sera toute la zone euro qui sera contaminée. La crise grecque est minime par rapport à un éventuel échec italien. Si l’Italie échoue, ce sera une affaire trop grosse pour la zone euro.

– Comment la Suisse pourrait-elle tirer profit de la reprise en Europe qui s’installe?

– La Suisse est un cas particulier. Sa croissance est concentrée dans les secteurs pharmaceutique et chimique. Dieu merci, des gens seront toujours malades et le marché des médicaments est assuré dans toutes les circonstances. En revanche, la chimie est plus dépendante de la conjoncture. Dans le cycle actuel, on peut dire que la Suisse se trouve dans une situation plutôt saine. En revanche, elle n’est pas à l’abri des conséquences d’un franc surévalué sur les exportations, plus particulièrement pour les exportations de produits et de services à faible valeur ajoutée. Le tourisme souffre aussi du franc fort.

Ceci dit, la Suisse se trouve dans une situation plutôt confortable grâce à ses nombreux autres atouts: un marché de travail flexible, une paix sociale, une modération salariale. Elle va bien aussi longtemps que la zone euro, son principal marché, croît. Mais attention à l’Italie; elle peut faire dérailler la zone euro et par ricochet, la Suisse.

– Enfin, la mondialisation. Le sujet fait débat dans les pays industrialisés. Des dirigeants politiques dont le président américain Donald Trump et plus récemment le président français Emmanuel Macron, prônent le protectionnisme…

– Les économistes ont fait une lourde erreur. Ils ont dit que l’intégration et le progrès technologique sont très bons pour l’économie. Mais ils ont oublié de dire qu’il y a aussi des perdants. On a toujours su que la mondialisation crée des inégalités. Les politiques le savent aussi, mais ils ne l’ont pas dit non plus.

Une frange de la population a effectivement profité de la mondialisation alors qu’une autre, celle qui n’a pas une bonne formation et qui s’adonne à des activités peu lucratives, est perdante. Cela a duré pendant au moins vingt ans, provoquant une grande colère. Résultat: les Américains ont élu un Trump à la tête des Etats-Unis et les Britanniques ont approuvé le Brexit.

– Comment agir à partir de ce constat?

– Taxer les riches, comme l’avait préconisé le président Hollande, fait fuir les entrepreneurs. Ce n’est pas en pénalisant les élites qu’on comblera le fossé entre riches et pauvres. Dans les pays industrialisés, la solution passe par l’éducation des jeunes et par la formation pour les moins jeunes. Dans un pays comme la France, fabriquer des appareils ménagers n’a pas de sens. Dans vingt ans, l’Europe arrêtera de produire de l’automobile, comme elle a arrêté de produire la charrue.

Il faut protéger les personnes, pas les emplois. Nous pouvons regarder l’exemple des pays scandinaves. La Suède, par exemple, est relativement petite et très mondialisée. Elle s’est transformée complètement ces dernières années et a fait de la place pour les jeunes dans des activités technologiques. Des personnes plus âgées ont abandonné des métiers dépassés et ont été formées pour des métiers qui resteront indispensables: commerciaux, comptables ou techniciens.

Charles Wyplosz: «Wolfgang Schaüble est un criminel»

Publié dimanche 21 mai 2017

|

| Charles Wyplosz |

Selon les dernières prévisions conjoncturelles,

l’économie mondiale s’est mise dans un cycle de croissance. Une grande

récession, comme celle des années trente, a été évitée grâce aux mesures

énergiques adoptées tant par les Etats que par les banques centrales.

Professeur d’économie à l’Institut des hautes études internationales et

de développement (IHEID) de Genève, Charles Wyplosz analyse le climat

d’optimisme dans la zone euro et met en garde contre les risques de

dérapage.

Le Temps: Les études conjoncturelles annoncent le début d’une reprise mondiale durable. Partagez-vous aussi ce sentiment?

Charles Wyplosz: Pour ma part, je ne fais pas les prévisions. Je constate néanmoins que la consommation est repartie dans les pays industrialisés. Sans elle, il n’y a pas de reprise. Elle est robuste aux Etats-Unis ainsi qu’en Europe. On s’interroge sur ce qui se passe au Royaume-Uni. Les pays en développement souffrent, mais ne pèsent de toute façon pas beaucoup dans la création de la richesse mondiale, à l’exception de la Chine. Qui, pour l’instant, tient bon.

– Mais quand est-ce que cette amélioration se fera-t-elle ressentir dans la zone euro?

Le Temps: Les études conjoncturelles annoncent le début d’une reprise mondiale durable. Partagez-vous aussi ce sentiment?

Charles Wyplosz: Pour ma part, je ne fais pas les prévisions. Je constate néanmoins que la consommation est repartie dans les pays industrialisés. Sans elle, il n’y a pas de reprise. Elle est robuste aux Etats-Unis ainsi qu’en Europe. On s’interroge sur ce qui se passe au Royaume-Uni. Les pays en développement souffrent, mais ne pèsent de toute façon pas beaucoup dans la création de la richesse mondiale, à l’exception de la Chine. Qui, pour l’instant, tient bon.

– Mais quand est-ce que cette amélioration se fera-t-elle ressentir dans la zone euro?

Avec l’élection de Trump et le vote en faveur du Brexit, les citoyens américains et britanniques réalisent qu’elles ont créé des situations difficiles. Les résultats de récentes élections aux Pays-Bas, en Autriche et tout récemment en France, montrent que les frustrations refluent. J’espère que cette tendance se poursuivra en Italie où le Mouvement 5 étoiles, même s’il n’est pas ouvertement raciste, garde un pouvoir de séduction.

– Puisque les cycles économiques sont de plus en plus de courte durée, faut-il craindre un retournement rapide de la conjoncture?

– Non. Les cycles sont plutôt longs. Nous avons traversé, au début des années 2000, une longue période de croissance soutenue. Par la suite, il y a eu un effondrement, mais il a été bref grâce à l’intervention des banques centrales qui ont agi avec une force inhabituelle. Nous sommes maintenant dans une phase post-crise qui est assez longue.

– Donc tout va bien?

– Pour l’Europe, le cycle vient de démarrer, en 2013-2014. A ce stade, il est loin d’arriver à maturation. Il peut continuer deux à trois ans. Aux Etats-Unis, le chômage est très bas et l’inflation commence à apparaître. On peut s’attendre à un retournement dans deux ans.

Cela dépend aussi de ce que le président Trump fera en politique économique. Son plan de relance de 1000 milliards de dollars ne se matérialisera probablement pas. Et on attend toujours ses cadeaux fiscaux aux entreprises. Cela dit, il n’y a pas deux cycles qui se ressemblent. Depuis 1945, ils durent en moyenne cinq à six ans.

– Pour revenir à la crise dans la zone euro, vous disiez que les Européens ont trop tergiversé avant d’agir…

– La Banque centrale européenne (BCE) a assez mal réagi dans un premier temps. Elle ne s’est pas rendu compte qu’on allait vers une récession. Il y a eu par la suite une crise des dettes publiques. On a perdu deux à trois ans. Un changement de leadership est intervenu à la BCE et les nouveaux dirigeants ont compris les enjeux. La banque centrale est alors intervenue puissamment et lourdement avec une politique d’assouplissement monétaire et une communication efficace.

Du coté des gouvernements, en 2008, le G8 s’était réuni d’urgence aux Etats-Unis et avait recommandé une politique expansionniste urgente. A l’exception de la Chine et du Japon, personne n’a agi de façon significative. Bruxelles a même imposé une politique d’austérité, ce qui a donné lieu à une deuxième récession en 2011-2012. Les Etats européens sont toujours paralysés par le Pacte de stabilité, qui ne convient pas dans une période de crise. Et encore, la Commission Juncker a été plus souple que celle de Barroso qui n’a pas su prendre de la distance avec Wolfgang Schäuble, le ministre allemand des Finances.

– En quoi Wolfgang Schäuble est-il concerné?

– Il est responsable d’une politique d’austérité en Europe qui a créé plusieurs millions de chômeurs. C’est criminel. La Commission a obéi à ses ordres. Le ministre allemand aurait dû comprendre que l’Europe était dans une situation de crise historique et que la priorité n’était pas de réduire les déficits, mais de créer des emplois. Il fallait tirer les leçons de la Grande dépression des années trente. Alors que la crise battait son plein, le président américain Hoover disait que l’État devait donner l’exemple et se serrer la ceinture. C’était le contraire qu’il fallait faire.

– Est-ce qu’on n’attend pas trop de l’Allemagne en lui demandant de réduire ses excédents budgétaires et commerciaux?

– Je ne suis pas convaincu qu’il faille faire des reproches à Berlin sur ces points. L’impact sur l’Europe d’une relance budgétaire en Allemagne serait limité. Cela consisterait à dire aux Allemands d’accumuler des déficits et des dettes pour nous faire plaisir. Si j’étais un contribuable allemand, je ne serais pas d’accord. Du reste, ce sont le secteur privé, les entreprises et les ménages allemands, qui sont les grands épargnants. L’épargne est une affaire personnelle et ce n’est pas à l’État d’y intervenir.

En revanche, les Allemands ont tort de ne pas profiter des taux d’intérêt bas pour investir. Financièrement et logiquement, ce serait une bonne affaire. Les livres d’histoire reprocheront aux décideurs allemands leur vision frigorifiée. Ils pensent toujours à tort que les Chinois vont continuer à leur acheter des Mercedes et que cela leur suffit.

– Mario Draghi, président de la BCE, a annoncé la fin de son programme d’assouplissement monétaire pour décembre 2017. Est-ce le bon timing?

– Ses propos sont plus nuancés. Il a certes parlé de décembre, mais en réalité, il a dit qu’il pourrait le poursuivre si la situation l’exigeait.