|

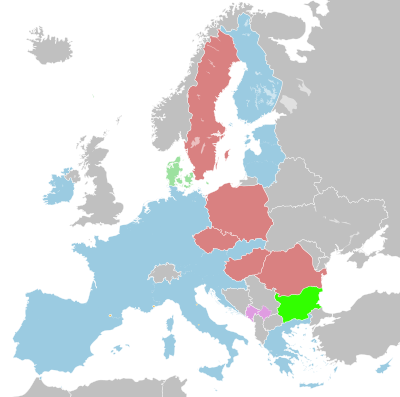

| Eurozone, or euro area (in blue). |

In 1998 I voiced my concern about the euro in a Fondad book, Regional Integration and Multilateral Cooperation in the Global Economy (1998), in which I said that I saw a major problem with an unbridled process of ever-deepening regional integration. "How far should it go? Isn't Europe's energetic embracing of a single currency, the Euro, now showing the pitfalls of integration that has gone too fast or too far? Should European nations not put more energy in keeping alive their rich variety of differences - in cultural, social, political and even economic life - rather than almost blindly following the new dogma of 'conversion' of economic policies? ... regional integration should never become a dogma. It is a useful and attractive project as long as those who are intended to benefit from it indeed reap the fruits. ... But on the day that citizens begin to raise serious and well-founded doubts about the supposed beneficial effects, policymakers and entrepreneurs should begin to rethink the wisdom of ever-increasing regional integration. In my view, regional integration should never become an end in itself, but it should be subdued to the broader and 'higher' goals of justice, social equality, cultural identity and respect for nature. In other words, social, political and cultural (and economic!) considerations can be good reasons for a revision of integration plans."

One of the dire consequences of the adoption of the euro was that the Member States of the eurozone (the official name is euro area) no longer had the freedom to implement the political, social and economic policies that their residents wanted. The Maastricht Treaty (1992) convergence criteria or conditions for entering the eurozone meant that a country had to subscribe to a whole set of neoliberal policies and keep its public debt and deficit and inflation at low levels. With these conditions the Maastricht Treaty legitimized and pushed for the austerity policies that since 2010 have been adopted in eurozone countries. Anyone who did not obey and wanted to pursue different policies was threatened with punishment.

The 'convergence' agenda of policies that member countries had to implement, and the establishment of the Eurogroup, ie the group of countries that have adopted the euro, meant in practice that member states had to follow neoliberal policies, even though this has never been explicitly mentioned. Other policies were simply not tolerated.

But, as has happened with the tough prescriptions by the IMF, the powerful countries can always disregard the Maastricht criteria when they think this is in their interest. Germany (after unification with Eastern Germany) and France are examples of poweful countries that broke the Maastricht budget deficit rule. Greece is an example of a weak country that could not escape from the straitjacket of the Maastricht Treaty and the neoliberal consensus of the Eurogroup (of which Greece is a part). When the Tsipras government in 2015 wanted to negotiate a debt deal with the Eurogroup and the ECB (and the IMF), it was simply told that its efforts to end austerity and get debt relief were meaningless as it just had to stick to the euro rules and the debt agreements made by previous governments.

Now that the disastrous consequences of the euro have become visible to more people than just the small group of expert critics, there is increasing doubt about the beneficence of the euro. In several countries voices have called for the abolition or reduction of the role of the euro, and the reintroduction of a national currency.

Right-wing populist leaders like Marine Le Pen and Geert Wilders have capitalized on the discomfort over austerity measures. They have announced that they will abandon the euro in their countries if they have the power to do so. Because the National Front of Le Pen in France and the Freedom Party of Wilders in the Netherlands do well in the elections and the polls, receiving more votes than any other party, the European technocrats defending the euro are concerned. They are feverishly searching for ways to prop up the European common currency. Their fear is that if one country leaves the eurozone, others might follow.

Ideas of how Europe could maintain the euro range from restricting it to a number of countries in northern Europe to democratizing the Eurogroup and giving its member states more freedom to implement the policies they see as fit.

There are also those who advocate reintroducing a national currency while preserving the euro as an international means of payment, just like the dollar. Is a breakup of the eurozone possible?

In a paper about the dismantling of the euro, "The Breakup of the Euro Area", the economist Barry Eichengreen, who has studied for many years the European monetary system and the international monetary system and has contributed to Fondad conferences and books, wrote in July 2007 that a country that abandons the euro and reintroduces a national currency might face major technical difficulties. But it can do it. One of the countries that might decide to leave the euro area was Portugal, he said, and another Germany:

"Different countries could abandon the euro for different reasons. One can imagine a country like Portugal, suffering from high labor costs and chronic slow growth, reintroducing the escudo in the effort to engineer a sharp real depreciation and export its way back to full employment. Alternatively, one can imagine a country like Germany, upset that the ECB has come under pressure from governments to relax its commitment to price stability, reintroducing the deutschemark in order to avoid excessive inflation."

A country where plans were made to withdraw from the eurozone and reintroduce the national currency was Greece. Are there similar plans in other countries?

to be continued (and revised)

No comments:

Post a Comment